Corporate Fraud: Types, statistical data and Prevention

Find out how to protect your company from corporate frauds with the adoption of prevention systems, risk identification and timely intervention

The Global Economic Crime and Fraud Survey 2020 produced by Price Waterhouse & Coopers provides an updated overview on frauds experienced by companies all over the World.

They surveyed more than 5,000 respondents across 99 territories about their experience of fraud over a period of two years. Nearly half of them reported that they have been victims of at least one incident in the past 24 months, an average of 6 each, for a global loss of 42 billion dollars.

PWC reports that the most common types were customer fraud, cybercrime, and asset misappropriation.

There was a roughly even split between frauds committed by internal and external perpetrators – respectively 37% and 39% - with the rest being mostly collusion between the two – 20%.

Frauds committed by customers tops the list of external perpetrators (at 26%) for the most disruptive incident, but also the list of all crimes experienced (at 35%, up since 2018).

Regarding the internal cases, middle management employee represent the highest number of offenders (34%), while third parties such as vendors and suppliers account for the 19% of the frauds reported.

On the latter, these business partners can be fraught with risk – a risk many companies have not formally addressed, as half of the companies surveyed lack a mature third-party risk programme and 21% have no third-party due diligence or monitoring programme at all.

Dogma can help overcome this issue through its Due Diligence service for companies.

Read PWC’s report on the most recent trends on corporate frauds.

But, taking a step back. What are corporate frauds and what are the most common types today?

Corporate frauds can be defined as the whole set of activities carried out for deceptive purposes aimed, indirectly and/or directly, in subtracting value from the business to provide advantage to those who commit such actions.

In order to prevent possible frauds, organizations must necessarily be aware of the main types.

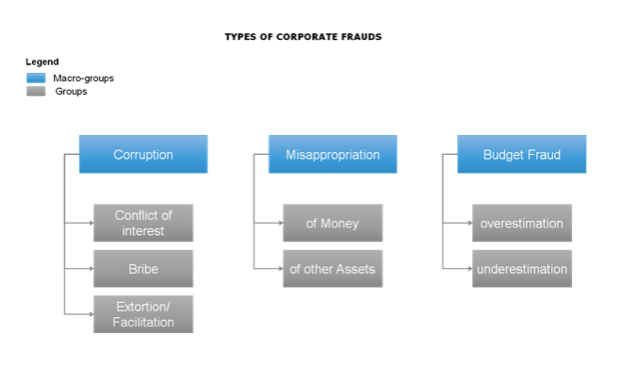

The ACFE (Association of Certified Fraud Examiners) provides one of the most precise representations of the corporate fraud landscape, classifying them into 3 macrogroups, then reworked in the chart below:

In each macrogroup there are other groups and subgroups which, in the original version, form a picture of about fifty different types of fraud. We have grouped them into 7 groups.

The first macro-group is about corruption and can mainly concern various areas.

Among these, the conflict of interest stands out, that is when an individual puts personal interest in a commercial transaction in the company. Often these are relationships established with the purchasing department, or relating to sales. Another type of corrupt fraud is the so-called. bribes that are requested or granted to be awarded or to have orders or contracts awarded.

The second macro group relates to crimes related to embezzlement, which can take place through taking possession of money. In some cases, as for skimming, this occurs even before the accounting of the transaction through the alteration of sales, trivially underestimating them, or canceling the credits to take possession of the money.

Other cases of misappropriation of money may instead concern the fraudulent outlay, which consists in over-billing, in the use of a non-existent supplier (or constituted ad-hoc) and in the alteration of expenses, checks and various payments. Clearly, it is also possible to misappropriate warehouse inventories or other goods in general. This fraud may concern activities ranging from the incorrect use of company assets to the blatant theft of objects owned by the organization.

The last macro group, not least, is that of budget fraud. In this type of fraud, reference is made mainly to all types of changes in the financial statements, such as trivially inflating or underestimating revenues or improperly evaluating company assets.

How to defend yourself from Corporate Frauds?

In short, companies face daily threats that can seriously damage their business. Globally, about 13% of respondents of PWC’s survey who experienced a fraud in the last 24 months reported losing more than US$50 million across all incidents.

Some organizations have a more developed fraud prevention system and are able to more easily evade the associated risks, while others do not yet have a well-structured anti-fraud culture.

The anti-fraud check-up is in fact composed of a checklist to which the company, possibly with the support of a fraud analyst, must respond with a score that will identify the exposure to corporate fraud risk.

The Fraud Risk Assessment is the most suitable activity to investigate and evaluate the complex of processes, procedures and business activities in order to identify their weaknesses. This activity is carried out by Dogma professionals, as an independent, independent and critical evaluation of the real vulnerabilities of the anti-fraud systems is necessary.

All companies, regardless of their size or type of business, can be exposed to the risk of corporate fraud, facing both economic and reputational damage.

Dogma is a reliable partner in the field of fraud and offers multiple preventive services such as anti-fraud check-ups, the most in-depth fraud risk assessments and ex-post consultancy and support regarding the fraudulent act.

We offer companies specific advice to protect themselves from the risk of corporate fraud of:

The ex-post investigation is carried out when a fraud is detected and when the internal system is unable to resolve it. Dogma, in this case, intervenes with maximum timeliness all over the world and, with the support of the Intelligence Division, has the purpose of recovering what has been lost and/or limiting the damage suffered.

Protecting yourself from fraud is important and produces visible benefits on the balance sheet and in terms of reputation.

Call the toll-free number to immediately receive a free and confidential estimate and advice, or use the form on the page to send us a request.

Author: Andrea Ingo

Intelligence Analyst - Fraud Investigation

A site is not enough to solve all doubts and above all to meet all needs. Use the form on the side or the CHAT to contact us, book an appointment and ask us for information.